Getting payroll right is harder than it looks. One mistake, like a missed TDS deadline or a delayed salary, and it can rattle employee trust or trigger penalties. That’s why so many growing businesses, from IT firms to manufacturing units, now rely on trusted payroll companies to handle the heavy lifting.

With the global payroll services market expected to hit $73.37 billion in 2025, there are more experienced hands than ever to help.

In this guide, you’ll find 10 reliable payroll companies in India and see how the right one can save you time, cut down errors, and let you focus on growing your business.

In a Nutshell:

- Choosing the right payroll companies ensures compliance, accuracy, and efficiency for your business.

- Key factors to consider include compliance expertise, scalability, data security, and integration capabilities.

- V3 Staffing is a leading recruitment solutions provider, offering tailored talent acquisition, staffing, and HR services to help businesses scale efficiently and stay compliant.

- Outsourcing payroll reduces costs, saves time, and helps businesses focus on growth by streamlining HR processes.

What Is Payroll Outsourcing?

India has become a prominent hub for payroll outsourcing, attracting both domestic and international companies seeking cost-effective and reliable solutions. In 2024, the Indian payroll outsourcing market was valued at approximately USD 339.5 million, with projections indicating it will reach USD 587.96 million by 2033.

Payroll outsourcing involves delegating the management and administration of payroll processes to external service providers. This allows businesses to focus on core operations while ensuring accurate compensation, tax filings, and compliance with labour laws.

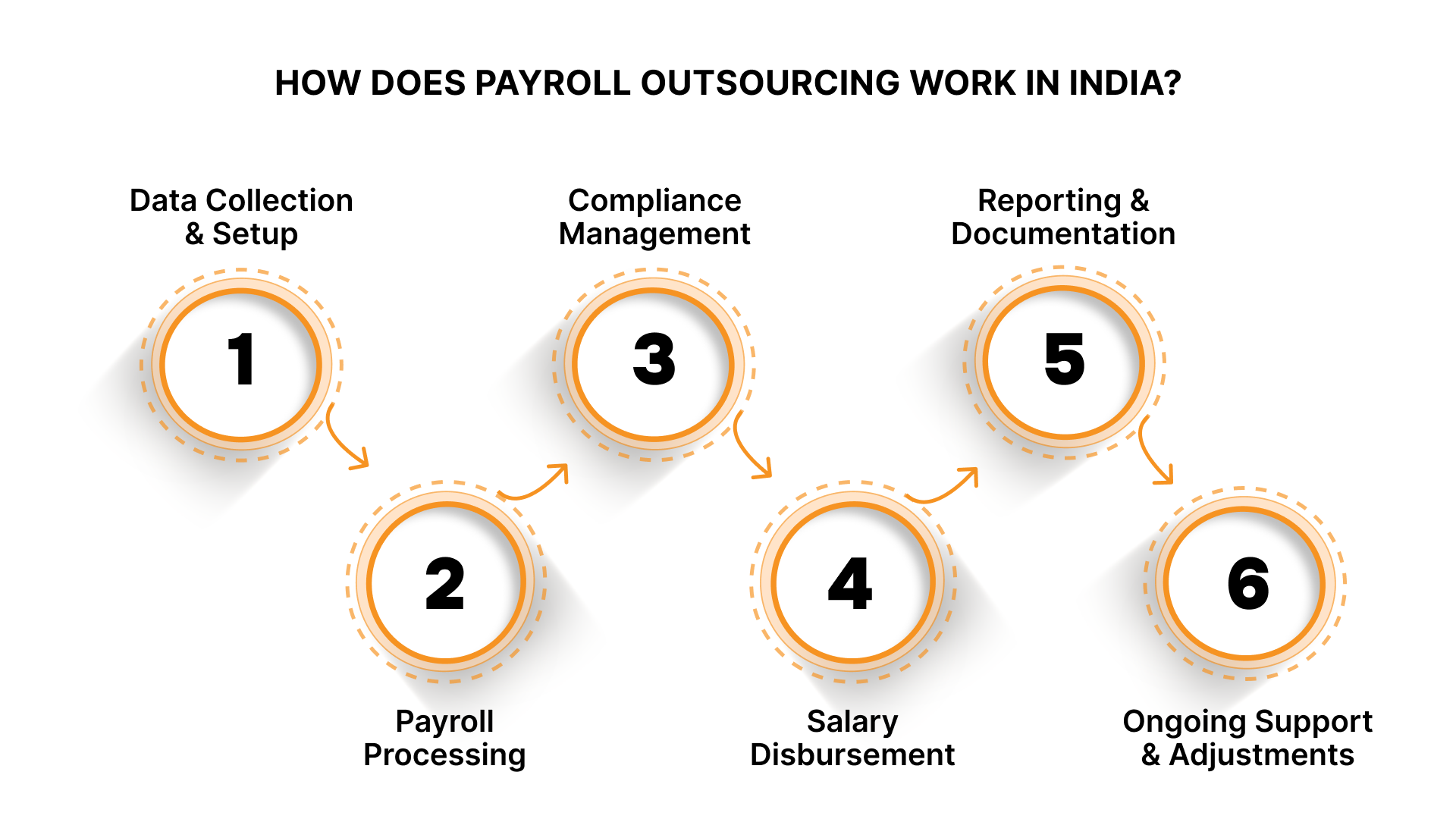

As payroll outsourcing continues to evolve, understanding how it works can help you make the most of its benefits. Here’s a breakdown of how the process typically functions:

1. Data Collection and Setup

You provide the payroll outsourcing service provider with the necessary employee details, salary structures, benefits, and any other relevant information. This setup also includes compliance data, like applicable tax rates and local labour laws.

2. Payroll Processing

The service provider processes the payroll, calculating salaries, deductions (like TDS, PF, ESI), bonuses, and other benefits. They use automated systems to ensure accuracy and efficiency while complying with Indian tax laws and labour regulations.

3. Compliance Management

The provider ensures all statutory compliance requirements are met, such as filing TDS returns, managing Provident Fund (PF) contributions, and handling Employee State Insurance (ESI). They stay updated with any changes in Indian labour laws.

4. Salary Disbursement

Once payroll is processed, the service provider disburses salaries to employees, either directly to their bank accounts or through other agreed-upon methods. They ensure timely payments, reducing the chances of delays or errors.

5. Reporting and Documentation

The provider generates payroll reports and other necessary documents like Form 16, payslips, and tax certificates. These are typically made available through an employee self-service portal, giving employees easy access to their payroll information.

6. Payroll outsourcing services also handle any adjustments for future pay cycles, such as promotions, bonuses, or corrections, ensuring that everything is up-to-date. They also provide customer support for resolving any payroll-related queries from both employees and employers.

Also Read: Benefits of Third Party Payroll Services for Companies

If you’re rethinking how payroll should work for your business, here are the top payroll companies in India that are helping others do just that.

Top 10 Payroll Outsourcing Services in India (2025)

Choosing a payroll partner isn’t just about outsourcing a function. It’s about handing over something sensitive, employee trust, compliance responsibility, and financial accuracy, to someone outside your business. That’s a big ask.

With many payroll companies offering similar promises, the real challenge is finding one that fits your structure and keeps up as you grow.

This list brings together 10 payroll companies in India:

1. V3 Staffing

Founded: 2009

Team Size: 200+ professionals

Headquarters: Hyderabad, India

V3 Staffing is a leading workforce solutions provider in India, specialising in permanent recruitment, temporary staffing, and IT staffing. Their integrated approach to talent acquisition and payroll management positions them as a trusted partner for mid-to-large enterprises in sectors like IT, BFSI, and manufacturing.

V3 Staffing operates in key cities like Hyderabad, Bengaluru, Chennai, Pune, Delhi NCR, and Mumbai, with extended reach into Tier-II cities, ensuring wide access to talent.

Features:

- Tailored Recruitment Strategies: Customises sourcing and hiring plans to fit your business culture, industry needs, and specific job requirements.

- Proven Success in High-Volume Hiring: Known for efficiently managing large-scale recruitment projects, especially for businesses scaling rapidly or experiencing high turnover.

- Leadership-Level Talent Search: Specialises in identifying top-tier leadership talent, providing a strategic edge for CXO, VP, and Director-level placements.

- Client-Centric, High-Touch Service: Dedicated account managers provide ongoing support and strategic recruitment advice, ensuring businesses receive personalised attention and quality hires.

Expertise and Specialisations

V3 Staffing provides tailored recruitment solutions across key industries, ensuring precision in every placement:

- Domain-Focused Recruitment: Dedicated teams specialising in IT, BFSI, Engineering, Automotive, and Shared Services, bringing in-depth sector expertise to every hire.

- End-to-End Talent Solutions: From mid-level roles to C-suite executive placements, V3 offers a full spectrum of recruitment services, meeting diverse organisational needs.

- SLA-Driven Delivery: Focused on delivering measurable outcomes with full accountability, V3 ensures transparency and timely results at every step of the recruitment process.

Pros and Cons

| Pros | Cons |

| Specializes in IT, BFSI, Engineering, and more. | May be less cost-effective for very small businesses. |

| Handles everything from talent acquisition to process automation. | Primarily targets larger, multi-location firms. |

| Adapts quickly to changes in business size and complexity. | Initial setup and integration with existing systems can take time. |

| Ensures full adherence to labour laws and regulatory standards. | May face challenges in highly niche recruitment for very specific roles. |

Need top executive talent? V3 Staffing’s Executive Search specialises in sourcing CXO, VP, and Director-level candidates with targeted headhunting and strategic sourcing. Let’s find the leadership your business needs!

2. ADP India

Founded: 1996

Team Size: 2,500+ professionals

Headquarters: Mumbai, India

ADP India is a global leader in payroll and human capital management, offering scalable payroll services, compliance expertise, and HR software solutions to businesses across industries.

Features:

- Global Payroll Solutions: Known for handling payroll and compliance in over 140 countries, providing cross-border payroll expertise.

- Advanced Automation and Reporting: Utilises advanced automation in payroll processing and offers comprehensive reporting tools for businesses.

- Employee Self-Service Platform: Provides a secure self-service portal where employees can access payslips, tax forms, and benefits.

- Integration with HR Systems: Seamlessly integrates payroll data with HR systems and accounting tools, improving overall HR management.

Pros and Cons:

| Pros | Cons |

| Cloud-based automation ensures accuracy and security. | Implementation may require time and effort. |

| Scalable solutions for businesses of all sizes. | Limited customisation for niche payroll needs. |

| Ensures full compliance with local and global regulations. | Primarily suited for medium to large businesses. |

3. Paybooks

Founded: 2017

Team Size: 50+ professionals

Headquarters: Bengaluru, India

Paybooks is a cloud-based payroll solution that streamlines payroll processing for businesses in India, ensuring compliance with labour laws and tax regulations for both SMEs and enterprises.

Features

- Affordable Payroll for SMEs: Focuses on delivering easy-to-use and affordable payroll companies for small to medium-sized businesses.

- Simple Compliance Management: Offers automated tax filings and ensures compliance with Indian labour laws, tailored to SMEs.

- Customizable Payslips: Provides businesses with the ability to customise payslips, making it easy to align with company needs.

- Real-Time Payroll Processing: Allows businesses to run payroll in real-time, enhancing the speed and accuracy of payroll processing.

Pros and Cons

| Pros | Cons |

| Cloud-based platform for real-time payroll processing. | Limited customisation for very complex payroll needs. |

| Multi-state compliance handling for businesses across India. | May be less suitable for global payroll needs. |

| Integration with accounting and HR software to streamline workflows. | Support may be more limited for very large enterprises with complex requirements. |

4. SBS HR Solutions

Founded: 2013

Team Size: 100+ professionals

Headquarters: Mumbai, India

SBS HR Solutions is a leading provider of payroll and HR outsourcing services in India, specialising in comprehensive solutions for small and medium-sized businesses.

Features:

- End-to-End HR Outsourcing: Specialises in offering complete HR outsourcing, including payroll, recruitment, and benefits management.

- Focus on SMEs: Primarily tailored for small and medium-sized enterprises (SMEs), providing a cost-effective solution for payroll and HR services.

- Comprehensive Compliance Management: Handles all statutory compliance aspects, ensuring businesses meet legal obligations without hassle.

- Customizable Payroll Solutions: Provides businesses with payroll systems that can be customised to suit specific needs, including flexible pay structures.

Pros and Cons

| Pros | Cons |

| Compliance management across Indian labour laws. | Limited support for global payroll requirements. |

| Employee self-service portal for easy access to payslips and documents. | Some customisation may be required for businesses with highly complex payroll needs. |

| Scalable solutions that grow with your business. | It may not be suitable for very large enterprises with unique requirements. |

Also Read: Explore Types of Recruitment to Improve Hiring in 2025

5. MYND Solutions

Founded: 2015

Team Size: 100+ professionals

Headquarters: Pune, India

MYND Solutions is a leading HR and payroll outsourcing provider in India, specialising in streamlining HR and payroll management for small to mid-sized businesses.

Features

- AI-Driven HR Automation: Specialises in using AI to streamline HR functions, from recruitment to payroll processing and compliance management.

- HR Process Outsourcing: Focuses on providing end-to-end HR outsourcing services, including talent management and payroll.

- Cloud-Based Solutions: Offers cloud-based payroll systems for easy access and scalability.

- Comprehensive Employee Lifecycle Management: Tracks the entire employee journey, from recruitment to performance and payroll.

Pros and Cons

| Pros | Cons |

| Cloud-based system for secure, real-time payroll access. | Limited customisation options for large enterprises with complex payroll needs. |

| Automated tax filing and compliance management. | May not offer full-scale solutions for global payroll needs. |

| Employee self-service portal for enhanced transparency. | Support may not be as extensive for larger teams with complex requirements. |

6. Keka HR

Founded: 2015

Team Size: 300+ professionals

Headquarters: Hyderabad, India

Keka HR is an HR and payroll management software that streamlines HR processes for businesses of all sizes, offering an integrated platform for payroll, performance, and employee management.

Features:

- All-in-One HR Platform: Combines payroll, performance management, and recruitment into a single, easy-to-use platform.

- Real-Time Payroll Processing: Enables businesses to process payroll quickly and accurately, with real-time updates and secure data handling.

- Employee Engagement Tools: Focuses on enhancing employee experience with features like performance tracking, recognition, and feedback systems.

- Leave and Attendance Management: Integrates attendance tracking with payroll, ensuring accurate salary disbursements based on actual work hours.

Pros and Cons

| Pros | Cons |

| Fully automated payroll with compliance management. | Primarily focused on Indian businesses; lacks international payroll support. |

| Employee self-service portal for easy access to payslips and benefits. | More suitable for medium to large businesses. |

| Integrated HRMS platform that combines payroll, performance, and more. | Limited customisation for niche payroll needs. |

7. Quikchex

Founded: 2014

Team Size: 50+ professionals

Headquarters: Bengaluru, India

Quikchex is a cloud-based payroll and HR management platform for small to medium-sized businesses, streamlining payroll processing while ensuring compliance across India.

Features:

- Simplified Payroll for SMEs: Focuses on providing affordable and easy-to-implement payroll solutions for small to medium-sized businesses.

- Compliance and Tax Filing Automation: Ensures accurate tax filings and compliance with Indian labour laws, reducing the risk of errors.

- Employee Self-Service: Offers employees an easy way to access payslips and update personal information via a user-friendly portal.

- Flexible Payroll Setup: Allows businesses to quickly set up payroll systems for different pay cycles, employee types, and taxation needs.

Pros and Cons

| Pros | Cons |

| Automated tax filing and compliance management, reducing manual effort. | Limited customisation for highly complex payroll setups. |

| Employee self-service portal, improving transparency and reducing HR workload. | Lacks advanced features required for large-scale enterprises. |

| User-friendly platform, easy for HR teams to adopt and manage. | May not scale well for businesses with rapid growth or large teams. |

8. ZingHR

Founded: 2015

Team Size: 100+ professionals

Headquarters: Mumbai, India

ZingHR is a leading HR technology platform offering cloud-based solutions for payroll, recruitment, and employee management. They focus on automating HR tasks for businesses of all sizes.

Features:

- Employee Lifecycle Management: Manages the entire employee lifecycle, from recruitment and onboarding to payroll, performance tracking, and exit management.

- Mobile-Friendly Platform: Provides a mobile app for employees to access payslips, track performance, and request leave, ensuring an on-the-go experience.

- Seamless Integrations: Easily integrates with other HRMS and ERP systems, ensuring smooth data flow across your organization’s HR ecosystem.

Pros and Cons

| Pros | Cons |

| Comprehensive HR suite with recruitment, performance, and payroll in one platform. | May require some training for teams unfamiliar with AI-driven systems. |

| Mobile access allows employees to manage their HR tasks on the go. | Customisation options for specific needs may be limited for niche payroll requirements. |

| Seamless integration with existing HRMS and ERP tools streamlines workflows. | Primarily targeted at businesses with advanced HR infrastructure, which might not fit very small businesses. |

9. GreytHR

Founded: 2014

Team Size: 200+ professionals

Headquarters: Bengaluru, India

GreytHR is a cloud-based HR and payroll software for small to mid-sized businesses, designed to streamline HR tasks.

Features:

- Integrated Leave and Attendance Management: Ensures seamless integration between payroll, leave, and attendance tracking, improving accuracy.

- Customizable Payslips: Businesses can design payslips and tax reports according to specific requirements.

- Simple HR Dashboard: Offers an intuitive HR dashboard that helps businesses manage payroll and other HR activities with ease.

Pros and Cons

| Pros | Cons |

| User-friendly interface makes payroll management easy for HR teams. | Primarily suited for small to medium businesses, may not meet the needs of large enterprises. |

| Automated compliance with TDS, PF, ESI, and other statutory requirements. | Limited customisation for highly complex or large-scale payroll structures. |

| Mobile app offers on-the-go access for employees, enhancing convenience. | Advanced features might be more complex for businesses with simple payroll needs. |

10. PeopleStrong

Founded: 2005

Team Size: 1,000+ professionals

Headquarters: Noida, India

PeopleStrong is a leading HR technology provider focused on enhancing employee experience and simplifying workforce management for businesses of all sizes.

Features:

- AI-Driven Talent and Payroll Management: Specialises in using AI to manage recruitment, payroll, and employee engagement, optimising HR processes.

- End-to-End HR Suite: Combines payroll with performance management, recruitment, and talent development in one platform.

- Focus on Employee Experience: Provides tools for improving employee engagement and performance, ensuring a strong talent management system.

- Scalable for Large Enterprises: Tailored for large enterprises with complex payroll and HR needs, offering scalable solutions for global operations.

Pros and Cons

| Pros | Cons |

| Mobile app for easy access to payroll, performance, and engagement tools. | Pricing may be higher for smaller businesses compared to simpler payroll providers. |

| Employee experience-focused platform that improves engagement and retention. | Advanced features may be overwhelming for businesses with basic HR requirements. |

| Real-time workforce analytics for data-driven decision-making. | Some complexity in the initial onboarding and setup. |

Also Read: Best Recruitment Agencies in India 2025

Now that you have an overview of the top payroll companies in India, it’s time to explore how to choose the right one for your business needs.

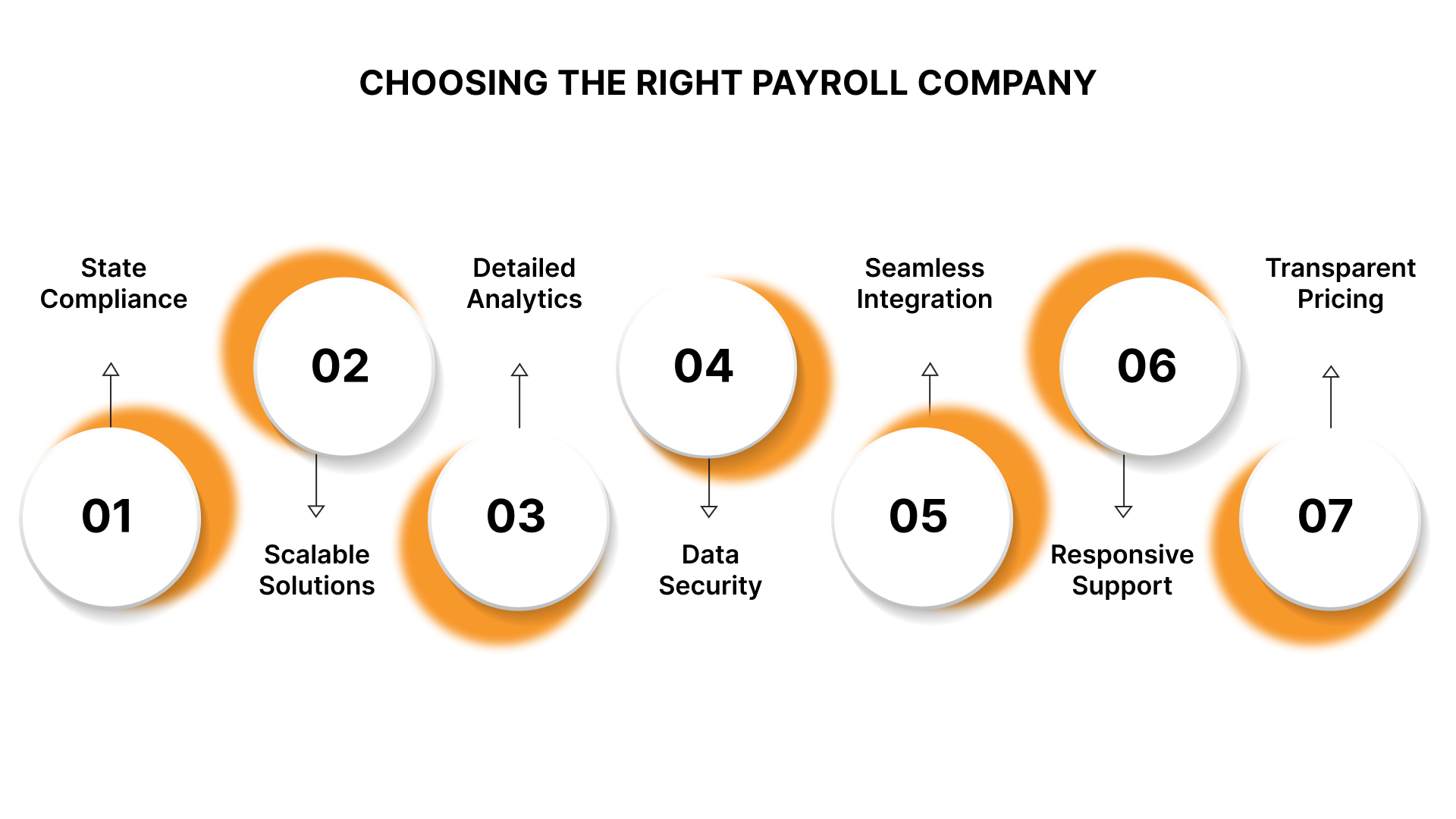

How to Choose the Right Payroll Company for Your Business?

Choosing the right payroll companies in India is a crucial decision for any business. With numerous providers offering various solutions, it’s important to find one that aligns with your company’s specific needs. Here’s what you should consider:

1. Compliance Across Multiple States

Indian businesses often operate in multiple states, each with different tax regulations. Your payroll service provider should have the capability to manage compliance in all the states where you operate.

For example, V3 Staffing excels in this area, ensuring that businesses stay compliant with local taxes, PF, ESI, and other statutory requirements across India.

2. Scalability to Match Your Growth

As your business expands, so do your payroll needs. The provider should have systems in place that can easily scale with you. For instance, if you suddenly hire a large number of contract staff, the provider should handle this increase in complexity without issue, offering flexible solutions.

3. Advanced Reporting and Analytics

Your payroll provider should offer detailed, real-time payroll reports that help you track not only employee payments but also taxes, deductions, and compliance metrics. These insights are valuable for budgeting, planning, and financial decision-making.

4. Security of Payroll Data

Security is a major concern, especially when it comes to sensitive employee data. Ensure your payroll provider uses robust encryption, multi-factor authentication, and complies with data protection regulations.

This reduces the risk of data breaches, a critical factor when handling payroll data.

5. Ease of Integration with Other HR Functions

Your payroll provider should integrate seamlessly with other HR systems like employee benefits, time tracking, and performance management. For example, if your payroll provider can easily sync with your HRMS, it reduces manual errors and makes the payroll process faster and more accurate.

6. Customer Support and Responsiveness

Effective support is key when issues arise. Whether you have questions about tax calculations or need help with year-end filings, the provider should be easy to reach and responsive.

A good provider offers dedicated support teams that assist you throughout the year, not just during payroll processing.

7. Transparent Pricing with No Hidden Costs

Ensure that the provider offers clear pricing structures, with no hidden fees for extra services. A transparent, cost-effective solution is essential to avoid unexpected costs that could strain your budget, especially for small to mid-sized businesses.

Also read: Recruitment Metrics That Matter: How to Measure Success in Permanent and Contract Staffing

Choosing the right payroll service provider is crucial for smooth operations and compliance. V3 Staffing, with its expertise in recruitment and staffing, offers end-to-end solutions to streamline HR processes and ensure compliance as your business grows. Make the right choice to optimise your workforce management and support your business growth.

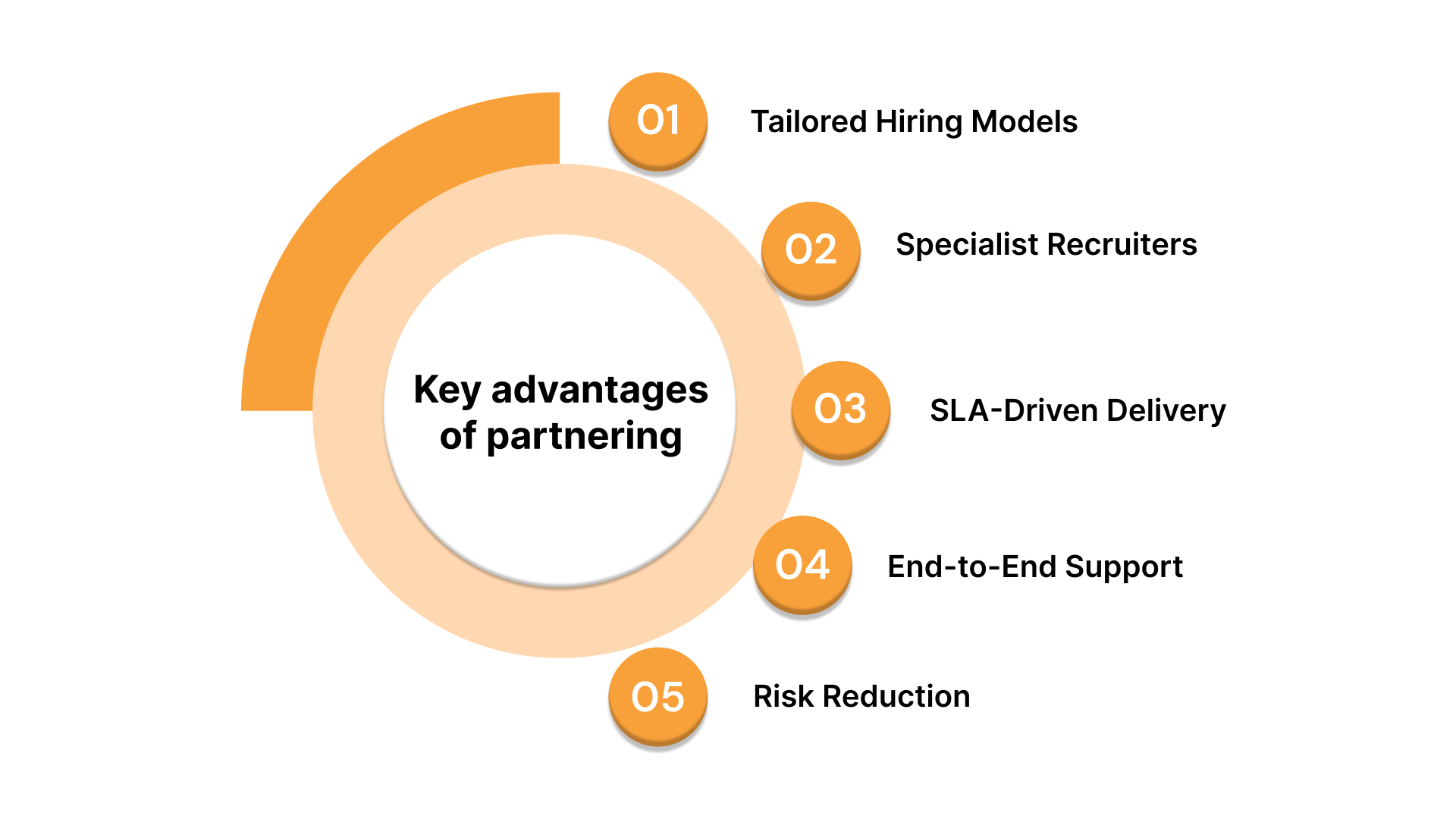

How V3 Staffing Helps Businesses Achieve Staffing Excellence

V3 Staffing is not just about recruitment; it’s about providing strategic workforce solutions that drive business success. Serving mid to large enterprises across India, V3 Staffing offers a range of services designed to meet the diverse talent needs of organisations in an ever-changing market.

V3 Staffing operates in Hyderabad, Bengaluru, Chennai, Pune, Delhi NCR, and Mumbai, providing scalable talent solutions to both Indian and international companies.

From Permanent Recruitment to Temporary Staffing, IT Staffing, RPO, and Executive Search, we offer comprehensive services that align with your business goals.

Key advantages of partnering with V3 Staffing:

- Tailored Hiring Models: Flexible recruitment solutions based on project scope, skill demand, and organisational goals.

- Specialist Recruiters: Domain experts who understand the nuances of tech, BFSI, manufacturing, and shared services hiring.

- SLA-Driven Delivery: Every engagement is governed by clear timelines, quality metrics, and accountability standards.

- End-to-End Support: From role scoping to onboarding, V3 manages the full hiring lifecycle to reduce client effort and time-to-hire.

- Risk Reduction: Rigorous screening, cultural alignment checks, and offer-to-join management to reduce attrition and mismatches.

Whether addressing time-to-hire, quality concerns, or regional hiring needs, V3 Staffing helps simplify external hiring with consistency and professionalism across India.

Conclusion

Beyond accurate salary disbursement, they specialise in comprehensive HR solutions, including tax filings, compliance with Indian labour laws, and process automation.

By partnering with V3 Staffing, you gain access to scalable recruitment services, streamlined HR operations, and improved workforce management. This allows your business to focus on growth while leaving the complexities of HR and payroll in trusted hands.

Looking for a recruitment partner who understands your hiring challenges? Contact V3 Staffing today and strengthen your workforce with precision and confidence.

FAQs

1. How do I know if a payroll provider is reliable?

Reliability in a payroll provider comes from their ability to deliver timely and accurate salary disbursements. Look for clear communication, regular updates, and transparent processes. It’s also essential to choose a provider with industry certifications, positive client testimonials, and strong customer support, which all indicate a proven track record.

2. Will my employees be able to access their payroll information easily?

Yes, most payroll providers now offer self-service portals where employees can access their payslips, tax forms, and reimbursement details 24/7. This not only improves transparency but also reduces HR’s workload. Providers like V3 Staffing ensure that employees can easily access their payroll information whenever they need it.

3. How can payroll outsourcing help reduce operational costs?

Outsourcing payroll eliminates the need for in-house payroll staff, saving on training and retention costs. It also reduces inefficiencies and errors associated with manual payroll processes. By streamlining payroll management, providers like V3 Staffing help businesses lower overhead costs and focus on core activities.

4. How do payroll outsourcing services handle multi-state operations?

Payroll outsourcing providers like V3 Staffing manage multi-state operations by ensuring compliance with each state’s labor laws and tax regulations. They handle state-specific tax filing and benefit calculations, making payroll management easy, regardless of your business’s geographic reach.

5. What are the benefits of outsourcing payroll over handling it in-house?

Outsourcing payroll offers several benefits, including access to specialized expertise and advanced technology without the overhead of maintaining an in-house team. It also reduces the risk of compliance errors, as providers stay up-to-date with the latest tax regulations and labor laws. With payroll experts managing the process, businesses can focus on core activities, streamline operations, and ensure accurate, timely payroll management.