Managing payroll can often feel like a constant balancing act. Errors in deductions, delays in processing, or miscalculations can not only frustrate your employees but also expose your organisation to compliance risks and financial penalties. In fact, 72% of small businesses in India report frequent payroll errors, which indicates how challenging accurate payroll management can be for HR and delivery leaders.

As someone responsible for ensuring smooth and reliable payroll operations, you need clear, structured processes to ensure deductions are accurate and consistent. Knowing the different types of payroll deductions and their impact on salaries, taxes, and benefits helps you make informed decisions and stay compliant with labour laws.

A well-defined approach can reduce manual effort, build employee confidence, and support a predictable payroll structure that employees trust. This blog explores the different types of payroll deductions, how they apply in practice, and the steps organisations can take to remain compliant while maintaining employee trust.

Key Takeaways:

- Payroll deductions are amounts subtracted from an employee’s gross salary, including statutory, voluntary, pre-tax, and post-tax deductions, directly impacting net pay and compliance.

- Employers process deductions systematically by identifying, classifying, calculating, remitting statutory payments, and updating compliance requirements regularly.

- Businesses must understand different deduction types, employment category variations, and avoid common errors like incorrect calculations, missed deductions, and poor record-keeping.

- Using best practices such as automated systems, regular audits, clear employee communication, and proper documentation helps manage payroll accurately and reduces errors.

What are Payroll Deductions?

Payroll deductions are amounts an employer subtracts from an employee’s gross salary before paying the final take-home amount. These deductions cover statutory obligations required by Indian law and optional contributions agreed upon by the employee. They directly affect net pay, tax liability, and employee benefits, making accuracy essential for compliance and transparency.

While the structure of payroll deductions varies by country, most organisations encounter a mix of government-mandated deductions and voluntary benefit-related deductions across regions such as India, the USA, and the UAE.

Basic payroll deduction formula:

Net Salary = Gross Salary − Total Payroll Deductions

Where:

- Gross Salary includes basic pay, allowances, bonuses, and incentives.

- Total Payroll Deductions include statutory, voluntary, pre-tax, and post-tax deductions.

Example:

Consider an employee working in Bengaluru with a monthly gross salary of ₹60,000.

- Provident Fund (Employee Contribution): ₹3,600

- Professional Tax: ₹200

- Income Tax (TDS): ₹4,000

- Voluntary Health Insurance Premium: ₹1,200

Total Payroll Deductions = ₹9,000

Using the formula:

Net Salary = ₹60,000 − ₹9,000 = ₹51,000

This ₹51,000 is the employee’s take-home pay for the month, while the deducted amounts are remitted to relevant authorities or service providers by the employer.

Also Read: Benefits of Third Party Payroll Services for Companies

How Payroll Deductions Work?

Payroll deductions operate as systematic subtractions from an employee’s salary, processed during each pay cycle.

The following steps explain how deductions are processed during a typical payroll cycle:

- Identification of applicable deductions: Each employee’s payroll profile is reviewed to identify statutory deductions, voluntary contributions, and role-specific requirements based on employment type and location.

- Classification of deductions: Deductions are grouped as pre-tax or post-tax to determine how they affect taxable income and net pay calculations.

- Calculation based on salary structure: Deductions are calculated either as fixed amounts or percentage-based values, aligned with gross salary, statutory thresholds, and benefit agreements.

- Payroll processing and payslip generation: All approved deductions are applied during the payroll cycle, resulting in the employee’s net payable salary with a detailed payslip breakdown.

- Statutory remittance and reporting: Mandatory deductions such as PF, ESI, professional tax, and TDS are submitted to the relevant authorities within prescribed timelines.

- Ongoing review and compliance updates: Payroll teams review deduction rules regularly to reflect changes in tax laws, labour regulations, or employee benefit selections.

This structured approach helps organisations maintain consistency across payroll cycles, reduce errors, and give employees clear visibility into their salary components.

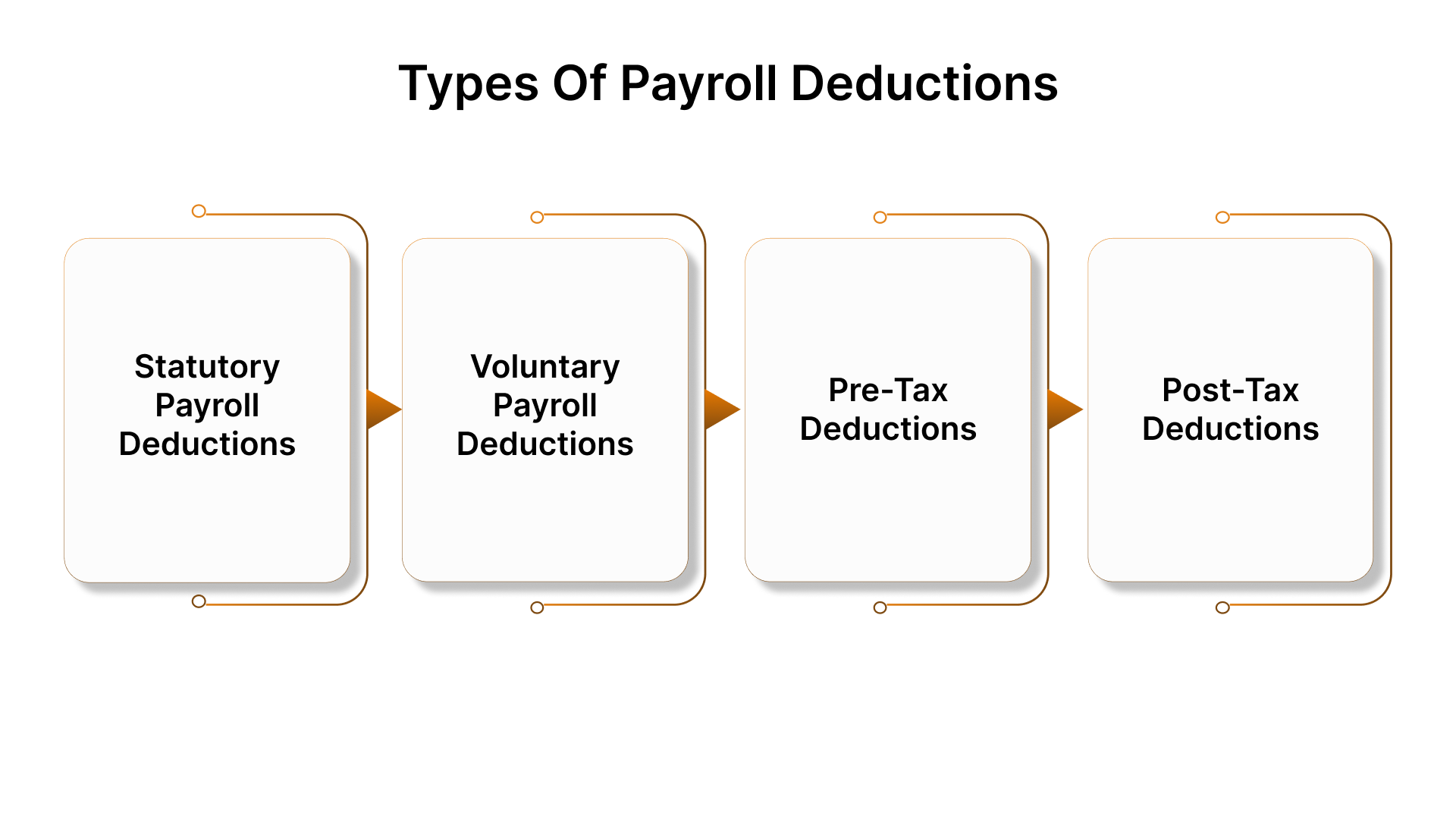

Types of Payroll Deductions

Payroll deductions can be grouped into four key categories based on their legal requirements and tax treatment. Each type affects employee take-home pay and employer compliance differently, making it important for businesses to understand how they apply in practice.

1. Statutory (Mandatory) Payroll Deductions

Mandatory deductions are amounts employers must legally deduct from employee salaries under applicable labour laws. These deductions are non-negotiable, and failure to process them correctly can result in penalties, fines, or other compliance issues.

- Employees’ Provident Fund (EPF): A retirement savings scheme where both employee and employer contribute a percentage of the basic salary.

- Employee State Insurance (ESI): A social security scheme that applies to eligible employees and provides medical and disability benefits.

- Professional Tax: Levied by state governments, this deduction varies by state and is taken from monthly pay.

- Tax Deducted at Source (TDS): Deduction towards income tax liability based on salary and tax slabs.

Statutory deductions are crucial for compliance and must be calculated and remitted in accordance with country-specific regulations, whether the organisation operates in India, the USA, or the UAE.

2. Voluntary Payroll Deductions

Voluntary deductions are contributions that employees opt to have deducted from their salary, often to access additional benefits or services. These can vary widely based on individual needs and company policies. Common examples include:

- Loan Repayments: Salary deductions for employee loans taken from the employer or financial institutions.

- Insurance Premiums: Health or life insurance premiums are deducted through payroll for employer-supported benefit plans.

- Voluntary Provident Fund (VPF): A higher contribution to retirement savings above the mandatory EPF limit.

- Professional or union fees: Membership fees are deducted based on employee consent.

These deductions provide value to employees and help support individual financial and welfare goals. They require clear documentation and written consent from the employee.

3. Pre-Tax Deductions

Pre-tax deductions are amounts subtracted from an employee’s salary before the calculation of taxable income. This reduces the employee’s taxable salary, offering potential tax advantages. Common pre-tax deductions in India include:

- Approved retirement schemes: Contributions that reduce taxable income when made to government-recognised funds.

- Eligible health insurance premiums: Certain insurance contributions are allowed as deductions before tax calculation.

- Tax-saving investment plans: Employee contributions under approved savings schemes that lower taxable salary.

These deductions help employees manage tax liability while requiring careful payroll configuration to remain compliant. If you are building teams across countries such as India, the USA, or the UAE, V3 Staffing supports structured hiring strategies that align compensation expectations with local market practices.

4. Post-Tax Deductions

Post-tax deductions are amounts withheld from an employee’s salary after tax has been calculated. These include:

- Loan and advance recoveries: Salary deductions made after tax calculation for repayments.

- Charitable contributions: Donations deducted through payroll that do not qualify for pre-tax treatment.

- Non-tax-benefit programmes: Employee benefit costs are deducted after applicable taxes are applied.

Post-tax deductions directly affect take-home pay and must be clearly reflected in payslips to avoid disputes.

Also Read: Top 10 Payroll Outsourcing Services in India 2025

Payroll Deductions Across Different Employment Categories

Payroll deductions can differ depending on the type of employment. Accurate categorisation avoids errors in withholding amounts, legal penalties, and employee dissatisfaction.

- Full-time employees: Typically subject to statutory deductions like EPF, ESI, professional tax, and TDS. They may also have voluntary deductions for insurance, retirement contributions, or lifestyle benefits.

- Contractual/Temporary Employees: Often have minimal statutory deductions, but may include professional tax or TDS depending on employment duration.

- Part-Time or Probationary Employees: Follow statutory deductions based on applicable state laws, but may have limited voluntary benefits.

Consistent payroll governance helps organisations apply deductions fairly across all employment categories, regardless of location.

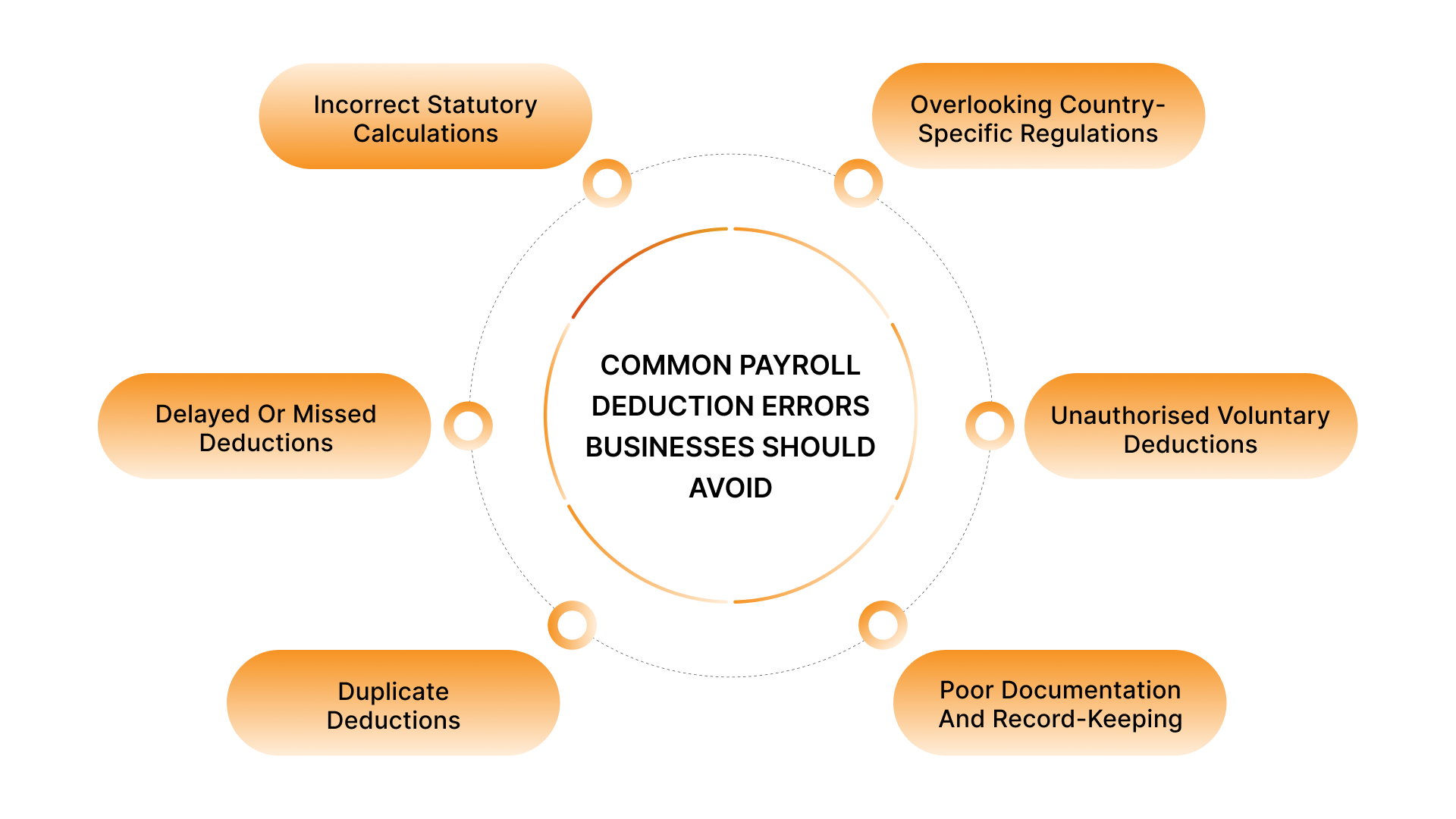

Common Payroll Deduction Errors Businesses Should Avoid

Payroll processing is complex, and even small errors in deductions can lead to legal issues, financial penalties, and employee distrust.

Common mistakes include:

- Incorrect statutory calculations: Errors in EPF, ESI, professional tax, or TDS calculations often arise from outdated rules or incorrect salary components, leading to compliance issues.

- Overlooking country-specific regulations: Professional tax and labour rules vary across multiple countries with different tax frameworks, which can cause errors.

- Delayed or missed deductions: Skipping deductions in a payroll cycle or processing them late creates reconciliation issues and reduces employee trust.

- Unauthorised voluntary deductions: Applying deductions without proper employee consent or documentation can trigger disputes and legal concerns.

- Duplicate deductions: System or manual errors can cause repeated deductions, which directly affect take-home pay and demand time-consuming corrections.

- Poor documentation and record-keeping: Incomplete records make audits difficult and increase the risk of penalties during inspections.

Avoiding such mistakes requires careful monitoring, accurate payroll systems, and professional expertise to ensure compliance and employee trust.

Best Practices for Managing Payroll Deductions Efficiently

Efficient management of payroll deductions improves compliance, reduces errors, and ensures timely salary disbursements. Key best practices include:

- Automated payroll systems: Utilising software that accurately calculates deductions based on statutory and voluntary criteria.

- Regular compliance audits: Reviewing deductions to align them with changing labour laws, tax rules, and state regulations.

- Employee communication: Providing clear breakdowns of deductions in payslips helps build transparency and trust.

- Centralised documentation: Maintaining records for all employee agreements, voluntary deductions, and statutory contributions.

- Partnering with experts: Collaborating with staffing and payroll service providers to streamline processes across multiple geographies.

These practices reduce operational risk and save administrative time and resources for HR teams, allowing them to focus on strategic initiatives.

How V3 Staffing Can Support?

V3 Staffing offers comprehensive recruitment solutions to support organisations with workforce, designed for MNCs and fast-growing startups with 100–200+ employees.

Here’s how we can assist you:

- Permanent Recruitment: Tailored hiring for critical full-time roles across mid to senior levels, leveraging industry-specialised recruiters and structured candidate evaluation processes.

- Temporary & Contract Staffing: Flexible staffing solutions for project-based work, peak demand periods, or interim needs, with rapid deployment across tech and non-tech roles.

- IT Staffing: Access to highly skilled technology professionals, including software architects, cloud engineers, DevOps specialists, and data scientists, with curated talent pools in major hubs.

- Recruitment Process Outsourcing (RPO): End-to-end recruitment management embedded within the startup’s team, offering SLA-driven delivery and cost-effective operations.

- Executive Search: Targeted hiring for CXO, VP, and Director-level roles, combining discreet headhunting with competency-based evaluation for strategic leadership positions.

By working with V3 Staffing, organisations can reduce operational complexity, strengthen compliance, and ensure payroll accuracy across domestic and international teams.

Conclusion

Payroll deductions are a vital aspect of managing employee compensation and organisational compliance. Understanding the different types of deductions, statutory, voluntary, pre-tax, and post-tax, is essential for ensuring accuracy, maintaining employee trust, and avoiding legal penalties.

For businesses operating across multiple countries, implementing best practices and utilising professional expertise can greatly simplify payroll management. Working with a reliable partner like V3 Staffing ensures smooth compliance with evolving labour laws and transparent reporting for employees.

Contact us today for more information and personalised support.

FAQs

Q. What role do gratuity and other retirement-related deductions play in payroll?

A. Gratuity and retirement-related deductions like PF contributions help employees save for post-retirement life. Employers deduct these from salaries to build long-term benefits, ensuring financial security, compliance with labour laws, and eligibility for pension or lump-sum benefits upon retirement or resignation.

Q. How does Employee Provident Fund (EPF) deduction work, and what is the current contribution rate?

A. EPF deduction is a retirement savings scheme where both the employer and employee contribute a fixed percentage of the basic salary and allowances. Currently, the standard contribution rate is 12% of basic pay from both sides, accumulating with interest for long-term financial security.

Q. What are Professional Tax deductions, and how do they vary by state in India?

A. Professional Tax (PT) is a state-level tax on salaries and income from professions. Employers deduct it monthly from employees’ wages. The rates, exemptions, and slabs vary across states, depending on local legislation, making it mandatory in some states and optional or non-existent in others.

Q. What is Employees’ State Insurance (ESI), and who is eligible for these deductions?

A. ESI is a social security scheme providing medical, sickness, and disability benefits. Employees earning up to ₹21,000 per month are eligible, with a contribution of 0.75% from employees and 3.25% from employers, ensuring healthcare coverage and social protection for workers in India.

Q. How do income tax deductions under TDS apply to different salary slabs in India?

A. TDS (Tax Deducted at Source) is deducted by employers from salaries based on applicable income tax slabs. The amount varies with the employee’s taxable income, exemptions, and deductions claimed, ensuring tax compliance and avoiding large lump-sum payments at the end of the financial year.